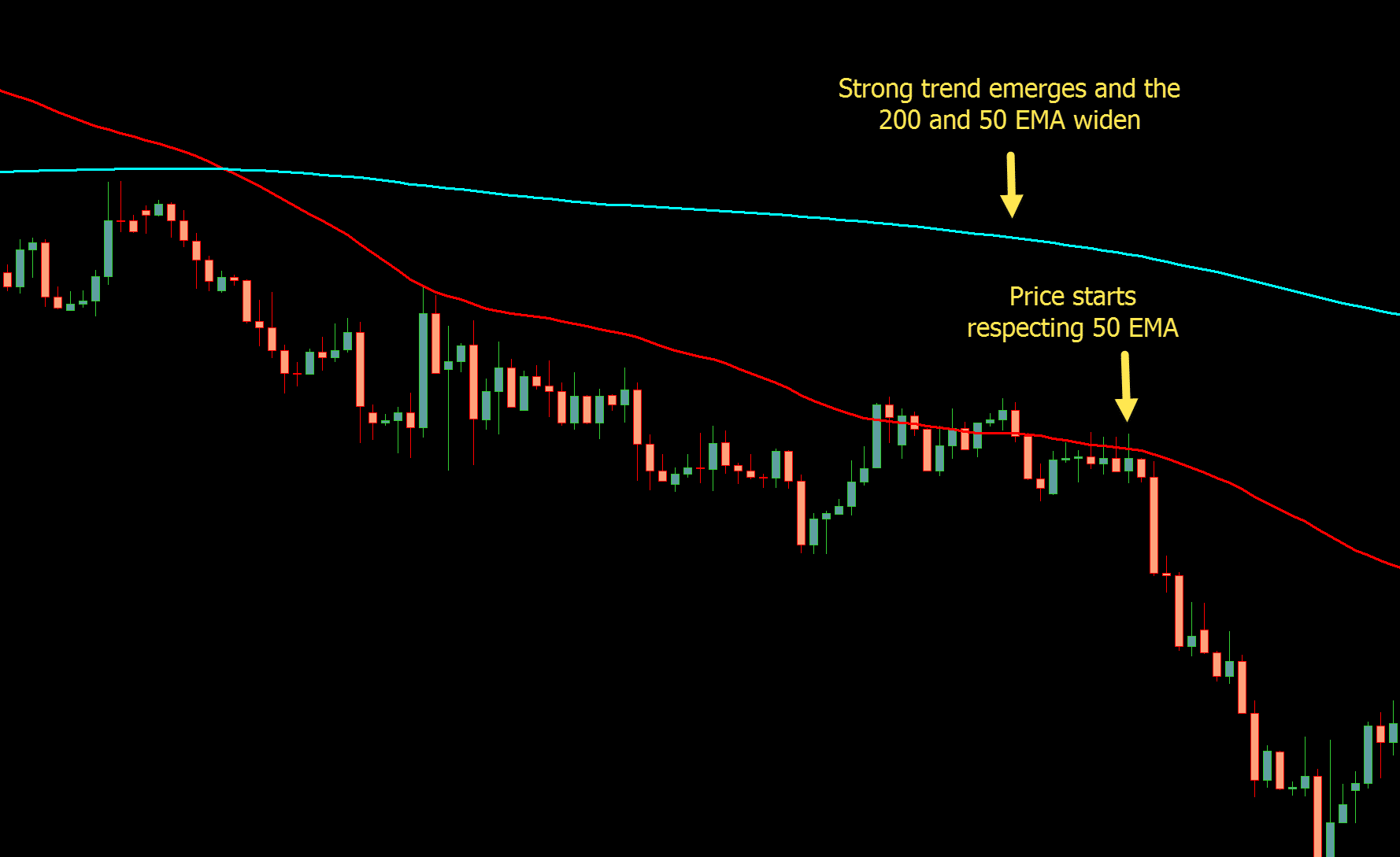

When a shorter MA crosses above the longer MA (i.e. MA crosses are also used to identify price trends. When prices break-through the support and resistance lines, it can indicate consolidation or a reversal. During strong up(down) trends, prices tend to bounce off of the support and resistance lines. MAs, especially SMAs, can also be used as support and resistance levels. Trend indication: when the price is above an MA, the trend is up, and vice versa. Also important are the time frames used to calculate the SMAs and EMAs – long-term traders should use longer time frames (60+ periods), medium-term traders should use 20-60 periods while short-term trades should use 5-20 periods. EMA reflects price changes faster and thus is better for short-term traders.

SMAs change slower than EMAs and thus is better for traders with longer time frames. Simple Moving Averages are calculated by taking an average of the closing prices for (5, 10…) periods.Įxponential moving average (EMA) puts greater weight on the most recent prices, and thus has less lag than SMAs it will react quicker to price changes. A type of moving average that gives more weight to recent price changes, meaning it reacts much quicker than. Two main MA types are the Simple Moving Averages (SMA) and Exponential Moving Averages (EMA) Definition of Exponential Moving Average (EMA). Moving Averages (MA) help identify price trends and potential support and resistance levels. Overall Score of Oscillators (Oversold / Overbought).Strong Up / Down Trend and Strong / Weak Ultimate Oscillator.Strong Up / Down Trend and Oversold / Overbought.Bollinger Band - Price Broke Upper / Lower Band.

0 kommentar(er)

0 kommentar(er)